Reverse supply chain

Published on: May 2021

The reverse supply chain has been coined for describing the movement happening from the end customer back to the point of origin. Reverse logistics has been happening since the advent of the trade. And due to any dissatisfied customer returning the goods back to the seller. However, the detailed planning of the operations has always been for forward logistics. Maybe because for too long the sellers have had greater bargaining power thus obviating the need, or because of unavailability of the tools and technologies to handle the complexity at such a small scale, or simply because obligations had never been greater.

All this has changed since the last few decades in developed countries and is changing at an accelerated pace in developing nations. Specific to India three forces are driving the focus on the reverse supply chain. The booming e-commerce sector, stringent enforcement of consumer rights and environment consciousness. These forces are discussed below in some details.

Although any form of trade is fundamentally based on trust, e-commerce has redefined the paradigms. The customer cannot even touch or feel the product and must order based on the pictures and reviews available on the platform. This may lead to expectations mismatch when the product is physically delivered. Then there are leakages or honest mistakes in the system that lead to wrong product delivery. All these scenarios result in return requests from the end customer and it is fair that if a customer is trusting the service provider to deliver the right product, the service provider reciprocates the same with a hassle-free return policy. The occurrence of returns is as high as 30% in some categories. At this scale, it becomes mandatory to have a planned approach to the reverse supply chain.

In conventional commerce too, there has been an increasing focus on the reverse supply chain. As Indian regulatory enforcements become stringent and implementation improves it becomes necessary for the brands to make sure that disposal of the expired products or the scrap happens as per the norms. There have been cases where expired products of leading FMCG brands have found way back into the market. This has a huge implication on the equity of the brand. Also, the products in the durables and auto sector that need to be disposed-off in an environmental friendly manner.

With increasing concern about the environment, the stakeholders need to reduce, reuse, and recycle the resources. Brands have begun to incentivise consumers to change their behaviour. Nestle’s “Maggi wrappers return” programme is one example in this direction. This is another opportunity for an organised reverse supply chain in waste management.

Given the above demand-side opportunities there are a few supply-side challenges that need to be addressed for the successful growth of the sector. These challenges pertain to the forecasting of the volumes, planning of the reverse logistics network and related IT systems.

Forecasting returns is a challenge not only because it happens for several reasons such as warranty claims, end of life returns, commercial returns but also because the buyer behaviour is unpredictable. For instance, the buyer may not return the product even after the end of its life. Planning of reverse logistics become difficult precisely because of this reason and because the returns’ grading and processing activities need better synergy with the activities performed in the nodes planned for forward logistics. Coupling this with a relatively much smaller scale of volumes for most of the brands, it becomes unviable proposition to do it themselves.

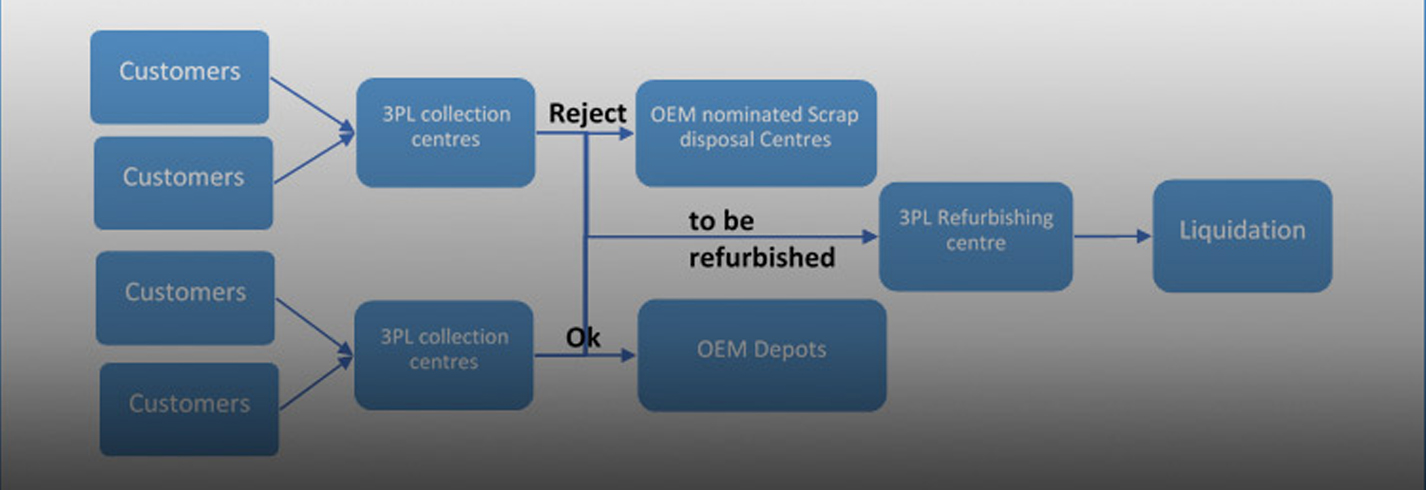

A viable proposition is to outsource the logistics to a 3PL company that has a scale by partnering with other brands, has the demonstratable capability, and is mature in the learning curve with ready systems and processes. Mahindra logistics does reverse logistics for leading e-commerce and FMCG brands across India.

Disclaimer: Views expressed here are the author’s personal views.